In a time when anti-immigration rhetoric is scaling new heights in the US and the EU, there is a bright spot in the U.S. migration story. A New York City pilot program teaches first-generation high school students financial literacy and entrepreneurship. It is a win for all communities involved.

Columbia University Small Business Development Center hosted a two-year pilot program for New York City high school juniors and seniors. The program was sponsored by New York Congressman Jerrold Nadler and funded by Wells Fargo. Through five weeks of classes, networking meetings with business professionals and field trips to meet with local entrepreneurs, the students learned bookkeeping, accounting, entrepreneurship and business management. By the end of the program, they were able to assist small business owners with their bookkeeping needs.

Glamis Haro, Senior Advisor, for the program, says programs like these are essential because they “correct an historical wrong.” These communities have been for centuries, and still are, economically disadvantaged. Programs like this are an essential first step to narrow the education and equality gap and develop this often-ignored talent pool.

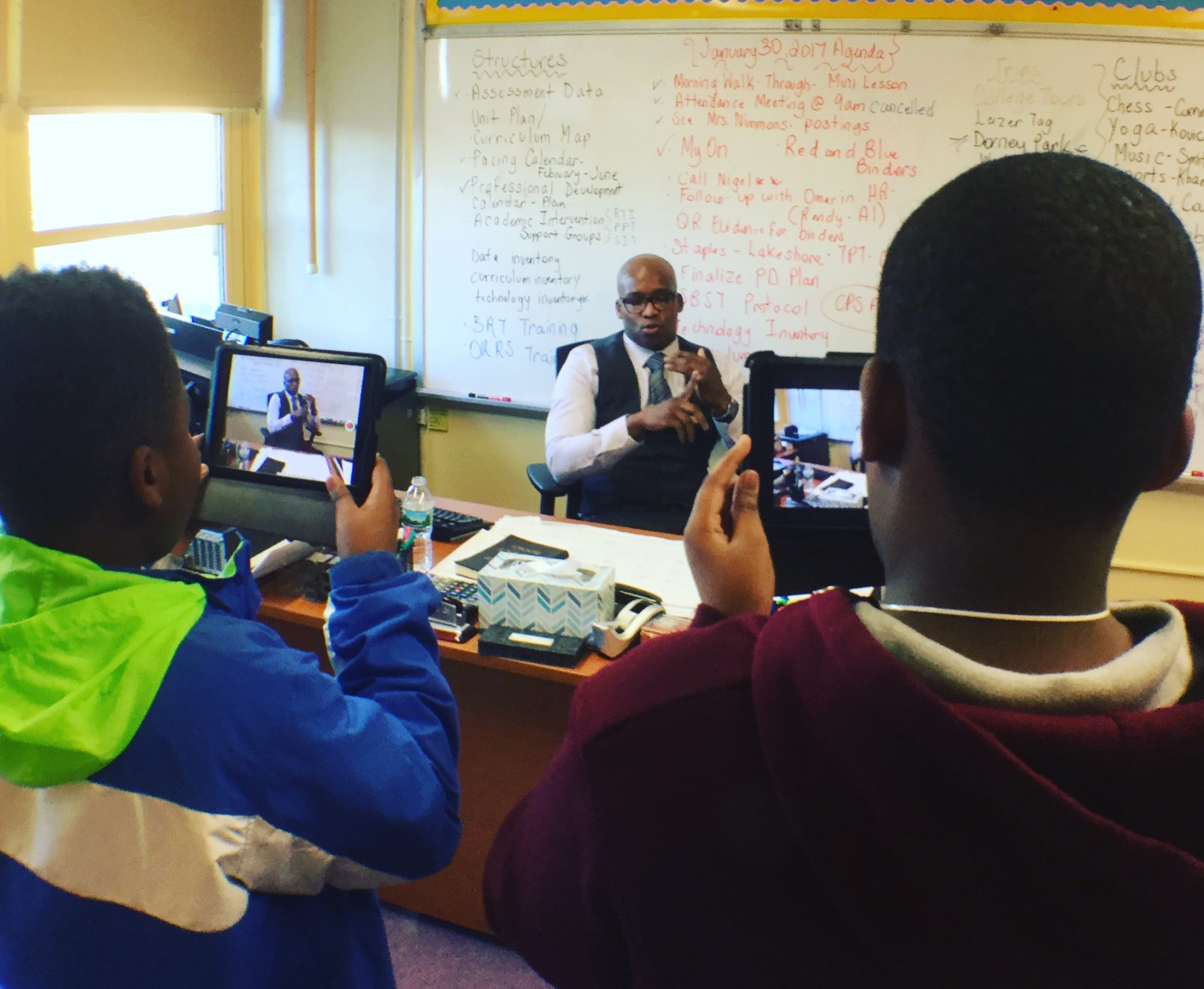

When we watch the video above in its entirety, we witness the thrill on the students faces as they collaborate on developing ideas for their small businesses. We see them question entrepreneurs that allow students to discover possible career paths in their own lives. If they work hard, set actionable and attainable goals and engage with their community, there is a place in the world for them to add and feel valued. Finally we see the students assist real-world small business owners balance their QuickBooks. We witness their joy, their discovery of being valued as a useful member of a community and how essential it is to a person’s development and sense of belonging.

According to the U.S. Office of the Director International Intelligence most people leave their home countries to pursue better socioeconomic opportunities. According to Time Magazine, immigrants, because they are multilingual and start a new life when they move to the U.S., bring a deep level of creativity and innovation to everything they pursue. They are stronger entrepreneurs than their U.S.-born counterparts. Because they have started a new life, sometimes many times before they arrive in the US, starting a company is in their DNA.

This sentiment is echoed by entrepreneur, Semyon Dukach, Managing Partner, One Way Ventures, an angel investor with a focus on helping immigrant VCs.

The U.S. Census Bureau projects that by 2030, 22.8 million children living in the US, meaning over 29% of the total U.S. population of children under 18, will be foreign born or have at least one foreign-born parent, up from 19.9 million U.S. children in 2020.

Rather than be frightened by the void of the other, we should see the possibility of a new world in that void. One not based on borders, on war machines, on nation states, all of which inevitably produce refugees. Rather than despise the refugees who come with nothing, and are nothing, we can identify with them and their nothingness. A blankness from in which we can imagine a world free from the forces that negate all of us: exploitation, violence, fear, terror, greed and selfishness.

“A Man of Two Faces,” Viet Thanh Nguyen

Resources for Children’s Financial Literacy

- FitMoney: Free financial literacy curriculum for K-12 students. They have a game-based learning platform called the $uperSquad that inspires elementary students to practice smart financial decision-making through real-world modules and activities. Also offers an online certificate program for students and teachers.

- W!SE: A nonprofit organization that provides free youth resources and courses on financial literacy for elementary, middle, and high school students. The mission of W!se is to improve economic mobility through programs that develop financial literacy and readiness for college and careers.

- The New York Public Library: Various programs and classes on financial literacy for kids and adults at different locations in NYC. They have workshops on topics such as money management skills, college savings plans, scholarships opportunities, career exploration, entrepreneurship, and more. Financial counseling services for individuals and families who need help with their finances.

- The National Financial Educators Council: Provides lessons, activities, tips, and resources for teaching kids about money from an early age.